- Nvidia’s earnings announcement is highly anticipated amid varied investor sentiments.

- Geopolitical uncertainty and trade tensions pose ongoing risks to the U.S. economic landscape.

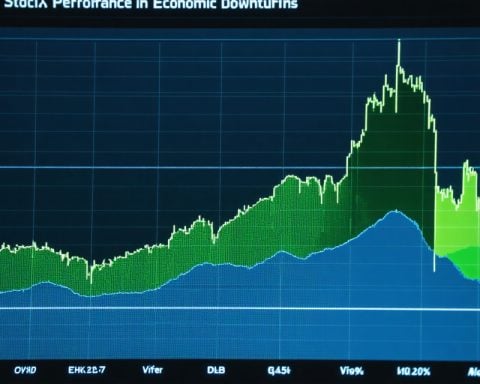

- Nvidia’s stock has shown significant sensitivity to past economic downturns, evidenced by substantial declines during periods of inflation and recessions.

- The Inflation Shock saw Nvidia’s stock plummet by 66%, while the COVID recession and Great Recession brought drops of 37.6% and 85.1%, respectively.

- Despite its impressive recovery ability, Nvidia’s stock volatility may deter risk-averse investors.

- Prudent investors might consider the Trefis High Quality Portfolio for a more stable investment with solid returns.

- Nvidia promises high rewards but requires careful consideration of associated risks.

As Nvidia gears up to announce its earnings, investors hold their breath for yet another show of strength from the AI giant. But beneath the surface of anticipation lies a more complex narrative—one that intertwines Nvidia’s past volatility with potential economic pitfalls under the trumpet serenades of tariffs and geopolitical uncertainty.

The U.S. economic landscape teeters on a precarious edge, where whispers of inflation and trade tensions orchestrate a symphony of risk. Even with inflation concerns temporarily pacified, any shift in the geopolitical winds could reignite economic volatility, and Nvidia’s stock history during turbulent times gives us pause.

Past downturns have not been kind to Nvidia. When the Inflation Shock hit between January 2022 and May 2023, Nvidia’s stock plunged 66%, an unsettling journey that underscored its vulnerability to market upheavals. The COVID recession saw a quick but steep 37.6% drop, demonstrating once more the stock’s sensitivity to macroeconomic tremors. During the Great Recession, Nvidia suffered a jaw-dropping decline of 85.1%, eventually clawing back over an arduous span of several years.

For the prudent investor, Nvidia’s volatile dance in sync with market downturns serves as a cautionary tale. While its bounce-back ability is remarkable, the roller coaster ride can be heart-stopping. For those wary of such wild rides, the Trefis High Quality Portfolio offers a smoother journey with commendable returns, presenting an alternative path through the economic fog.

In this tale, Nvidia entices with its highs but comes with a clear warning: adventure comes at a cost. Prepare wisely or consider safer havens.

Is Nvidia a Safe Bet? Exploring the Highs and Lows of Investing in the AI Giant

How-To Steps & Life Hacks for Navigating Nvidia’s Investment Risks

To invest in Nvidia responsibly, consider these steps:

1. Diversify Your Portfolio: Spread your investments across different sectors to mitigate risks associated with Nvidia’s volatility.

2. Stay Informed: Regularly monitor economic indicators, such as inflation rates and geopolitical developments, which could affect Nvidia’s performance.

3. Adopt Stop-Loss Strategies: Set automatic sell triggers to minimize potential losses during market downturns.

4. Focus on Long-Term Potential: Although Nvidia is prone to short-term fluctuations, its investments in AI and cutting-edge technologies might offer long-term growth.

5. Evaluate Alternative Investments: Consider balanced funds or portfolios that include more stable stocks—such as those recommended by experts at Trefis—to reduce risk.

Real-World Use Cases and Industry Trends

Nvidia is leading in the AI, gaming, and data center markets:

– AI and Machine Learning: Nvidia GPUs are critical for training AI models in industries ranging from healthcare to autonomous vehicles.

– Gaming: Their graphics cards are crucial for both PC and console gaming, with new technologies like ray tracing setting standards.

– Data Centers: Nvidia’s data center segment has boomed, largely due to increased demand for cloud computing and AI-based applications.

Market Forecasts and Industry Trends

– Nvidia is poised for growth with the increasing adoption of AI and the proliferation of data centers. MarketsandMarkets projects the AI market to grow at a CAGR of 36.2% from 2022 to 2027.

– Gaming continues to experience steady growth, with advancements in VR and AR presenting new opportunities.

Reviews & Comparisons: Nvidia vs. Competitors

Nvidia is often compared with its chief competitors, AMD and Intel, in areas like performance, efficiency, and pricing:

– Nvidia GPUs are typically praised for their superior AI capabilities and efficiency.

– AMD, however, is often seen as a cost-effective alternative, providing good performance for budget-conscious consumers.

– Intel attempts to compete with its in-house GPUs and CPUs that support AI tasks, but continues to trail behind in cutting-edge AI-driven technologies.

Controversies and Limitations

– Environmental Concerns: Nvidia faces criticism over its carbon footprint, as GPU production is energy-intensive.

– Supply Chain Issues: Geopolitical tensions, particularly regarding China, could disrupt supply chains and affect pricing and availability.

Features, Specs, and Pricing

Nvidia consistently updates its GPU lineup, with flagship models like the RTX 4090 offering top-tier performance for gaming and AI tasks. However, pricing is premium, reflecting the advanced technology and demand.

Security & Sustainability

Nvidia is investing in sustainability initiatives, focusing on reducing carbon emissions and improving the energy efficiency of its products. Security remains a priority, with regular updates to address vulnerabilities.

Pros & Cons Overview

– Pros: Leading technology in AI and gaming, strong market position, potential long-term growth.

– Cons: High volatility, susceptibility to geopolitical risks, high product prices.

Insights & Predictions

While Nvidia’s short-term performance might remain volatile given global economic concerns, its long-term potential in AI and data centers presents significant growth opportunities. Investors should weigh these prospects against potential risks.

Actionable Recommendations

– Invest Slowly: Consider dollar-cost averaging to smooth out entry costs during volatile periods.

– Monitor Geopolitical Situations: Keep an eye on global trade dynamics, particularly involving major players like China.

– Leverage Tools: Use platforms like ToolsLike.com to find resources that can help manage investment portfolios and automate trading strategies.

In conclusion, while Nvidia offers exciting opportunities, its path is fraught with volatility. Prudent investment strategies and diversified portfolios can help navigate these turbulent waters safely.