The world of technology investing is shifting rapidly. In the past year, artificial intelligence stocks captured significant attention, fueling market indices like the S&P 500 and Nasdaq to impressive gains. Yet, another revolutionary technology is gaining traction: quantum computing.

Quantum computing, distinct from its classical counterpart, leverages quantum mechanics to tackle problems far beyond the reach of traditional computers. Instead of using simple bits for processing, quantum systems utilize qubits, enabling them to solve complex issues at extraordinary speeds. While classical computers may take eons to compute a problem, a quantum computer could offer solutions within minutes.

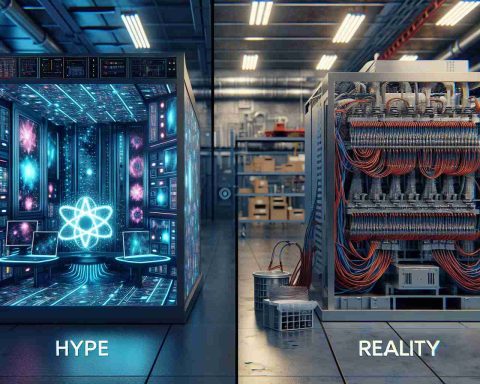

However, recent remarks by Nvidia’s CEO Jensen Huang suggested that practical quantum computers may still be two decades away. This news sent stocks of quantum computing firms like Rigetti and Quantum Computing tumbling—declines of nearly 45% in a single trading day rattled investors. Despite this setback, these companies have thrived over the past year, boasting gains exceeding 1,000%.

Rigetti has made strides in technology development, releasing the 84-qubit Ankaa-3 system, which has achieved notable accuracy improvements. Meanwhile, Quantum Computing is evolving its optical integrated circuits for quantum applications. Although both companies are not yet profitable, the groundwork for future breakthroughs is being laid.

With industry giants like Microsoft actively preparing for a quantum-ready future and Nvidia organizing its inaugural Quantum Day, optimism remains. Investors might see the value in holding onto quantum computing stocks, anticipating breakthroughs that could reshape technology in the coming years.

The Quantum Frontier: A New Era of Technology Investment

The rise of quantum computing brings with it profound implications for society, culture, and the global economy. As this cutting-edge technology matures, its potential to revolutionize industries—ranging from pharmaceuticals to cybersecurity—cannot be understated. Quantum computers could exponentially expedite drug discovery, optimizing complex molecular simulations that traditional computers struggle to solve. This could lead to rapid advancements in personalized medicine and better responses to emerging health crises.

Moreover, the economic ramifications are equally compelling. The quantum computing market is projected to reach $65 billion by 2030, attracting substantial investment that may fuel job creation across multiple sectors. However, the risk of widening the digital divide looms large; as quantum capabilities become available, only those with access to this technology may reap its benefits, potentially exacerbating existing inequalities.

Environmental effects also merit consideration. As quantum computing evolves, it could decrease energy consumption in data centers significantly compared to classical computing. This aligns with global sustainability goals, potentially reducing the carbon footprint of technology infrastructure.

As we venture further into this new landscape, staying attuned to the advancements in quantum computing will be essential. The ability to adapt and innovate in response to these developments could define competitive edges in various industries and shape the future of technology investing for years to come.

Quantum Computing: The Next Frontier in Technology Investing

As the technology investing landscape evolves, quantum computing is emerging as one of the most promising areas, matching the excitement previously reserved for artificial intelligence. While AI stocks have driven significant market gains over the last year, quantum computing is gaining momentum, offering investors a glimpse into the future of computing.

What is Quantum Computing?

Quantum computing distinguishes itself from classical computing through the use of qubits instead of traditional bits. This fundamental shift allows quantum systems to process vast amounts of data simultaneously, solving complex problems in seconds or minutes that would take classical computers much longer. The principles of quantum mechanics enable operations that are impossible in the classical realm, making quantum computing a revolutionary technology.

Pros and Cons of Quantum Computing

Pros:

– Unmatched Processing Power: Quantum computers can handle complex calculations at unprecedented speeds.

– Potential to Solve Intractable Problems: Areas such as cryptography, climate modeling, and drug discovery could benefit significantly.

– Innovation and Research Opportunities: Advances in quantum technology may lead to new business models and innovations.

Cons:

– Long Development Timeline: Experts, including Nvidia’s CEO Jensen Huang, suggest that practical quantum computers may not be ready for another 20 years, leading to volatility in stock values.

– High Development Costs: The technology requires substantial investment and expertise, which can be a barrier for smaller firms.

– Market Uncertainty: As the field is still in its infancy, the actual market and economic impacts remain unpredictable.

Notable Players in Quantum Computing

– Rigetti Computing: Recently released the Ankaa-3, an 84-qubit quantum system that has shown improved accuracy in computations. Despite its current lack of profitability, Rigetti has been a leader in technological advancements within the sector.

– Quantum Computing Inc.: This company is working on innovative optical integrated circuits tailored for quantum applications, highlighting the diversity in approaches within the industry.

Market Trends and Insights

Despite a recent dip in stock values—some firms saw declines of up to 45% following Huang’s remarks—quantum computing companies have seen incredible growth over the past year, with some reporting gains exceeding 1,000%. This volatility reflects the speculative nature of the field, which continues to attract both seasoned and new investors.

Innovations and Future Predictions

The field of quantum computing is rich with potential innovations. Industry leaders like Microsoft are investing heavily in quantum infrastructure and research, indicating strong support for the sector’s growth. The first Quantum Day organized by Nvidia marked a significant step in fostering industry dialogue and collaboration, suggesting that major tech firms are keen to stake their claim in this emerging market.

Limitations and Challenges

Despite its potential, quantum computing faces significant challenges:

– Technical Hurdles: Building stable qubits that can perform reliably is still a major obstacle.

– Integration with Classical Systems: There remains a gap in how these revolutionary machines will work alongside existing technologies, which could slow down adoption.

– Security Implications: Advanced quantum algorithms could pose risks to current encryption methods, urging a rethink of cybersecurity strategies.

Conclusion: The Future Landscape

Investing in quantum computing stocks is not without risk, but the potential rewards could be substantial. As technology advances and companies push boundaries, early investors may find themselves at the forefront of a revolution that reshapes industries. The message for current and prospective investors: Stay informed, track advancements, and be prepared for both volatility and exceptional breakthroughs in this exciting field.

For additional insights and updates on quantum computing, explore the evolving landscape at Microsoft, which is at the forefront of agricultural advancements and technology.