- Tesla’s stock has decreased by over 15% this year, with a significant 5.3% drop in just one day.

- CEO Elon Musk’s scattered focus on multiple ventures, including a conflict with OpenAI’s Sam Altman, is causing investor anxiety.

- Chinese automaker BYD is becoming a formidable competitor, unveiling advanced driver assistance systems in affordable vehicles under $10,000.

- Tesla is facing regulatory challenges in China, while the market speculates on the possibility of a fully autonomous vehicle release.

- Investors are questioning whether Tesla’s stock slump is temporary or indicative of deeper challenges for the company.

- The coming days are crucial for Tesla as stakeholders look for Musk to refocus on the company’s electric vehicle leadership.

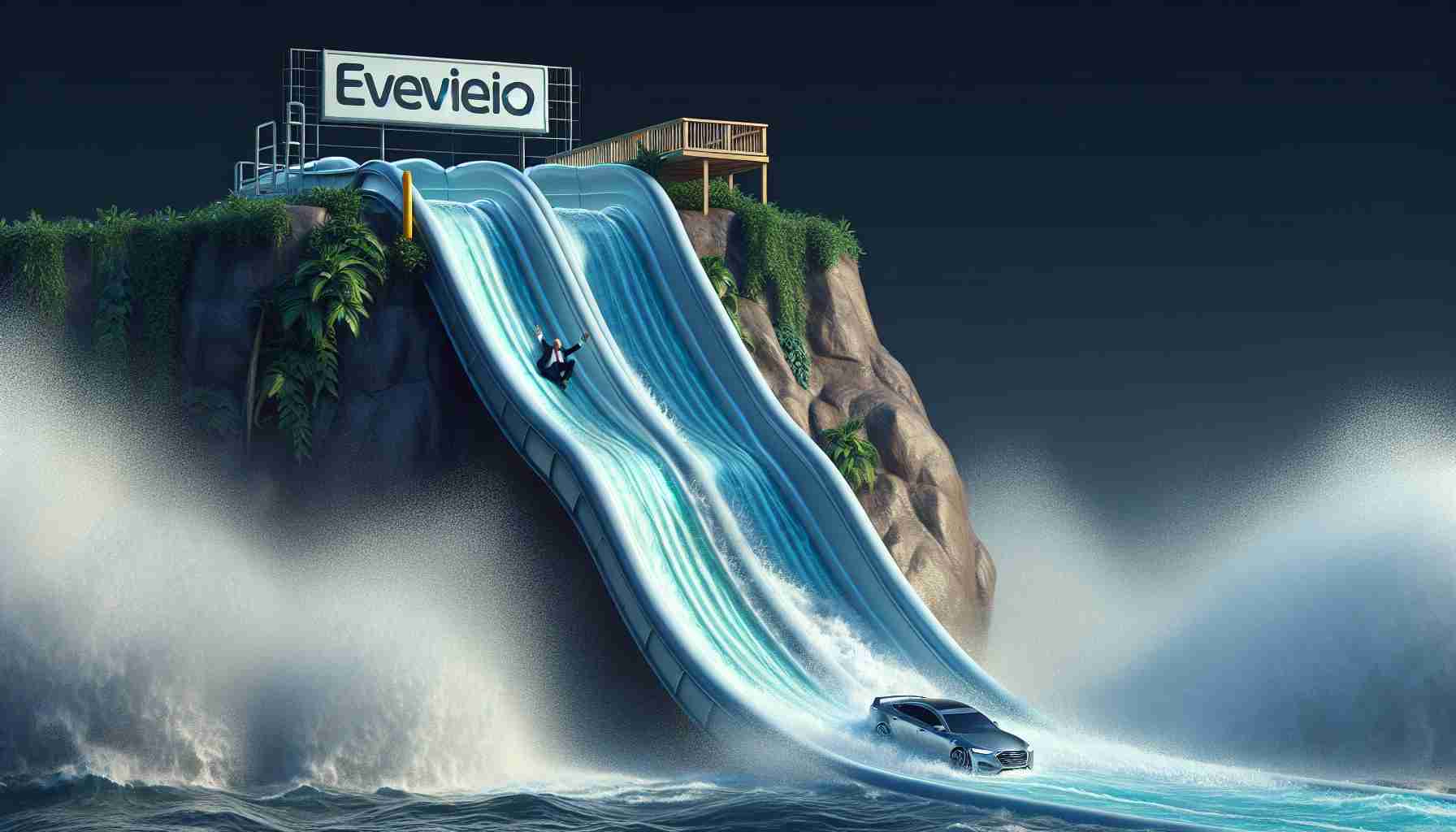

Tesla’s stock has plunged into a sea of red, leaving investors unsettled as it drops over 15% this year, with a dramatic 5.3% dip just today. The iconic leader of electric cars is grappling with turbulent waters stirred by its CEO, Elon Musk, whose attention seems scattered across a multitude of ventures.

Musk is currently locked in a new standoff with fellow OpenAI founder Sam Altman. Musk’s bid of $97.4 billion to reclaim the AI firm contrasts sharply with Altman’s ambitious $300 billion valuation, implying potential financial fireworks ahead. All this unfolds while Musk also dabbles heavily in ventures away from Tesla, leaving investors anxious about his focus on steering the EV ship.

Meanwhile, halfway around the globe, Tesla faces a formidable challenge—the rise of Chinese automaker BYD. In a bold move, BYD has unveiled a cutting-edge driver assistance system for its electric vehicles, including affordable models priced under $10,000. Utilizing DeepSeek’s AI technology, BYD is racing ahead as Tesla wrestles with regulatory hurdles in China.

Amid this swirling storm, Tesla’s dwindling stock may hint at hidden opportunities. The market seems to speculate whether Tesla will make a groundbreaking leap with a fully autonomous vehicle this year. But for now, the swift currents threaten to drag the stock deeper, testing the resilience of Musk’s empire.

As Tesla navigates these challenges, investors are left wondering whether this is merely a temporary slump or a warning signal of rougher seas ahead for the electric vehicle titan. The coming days will be crucial as stakeholders watch to see if Musk can realign his focus to quell the turbulence and reignite Tesla’s electric charge.

Is Tesla’s Current Stock Plunge a Hidden Opportunity or a Sign of Future Challenges?

Market Forecast and Analysis

Tesla’s stock has experienced significant volatility, with a 15% drop this year and a notable 5.3% decline recently. Such fluctuations have left investors questioning the underlying causes and potential future scenarios. Key factors contributing to this are CEO Elon Musk’s diversified interests, competitive pressures from Chinese automakers, and internal strategic uncertainties.

Pros and Cons of Investing in Tesla Amid Uncertainty

Pros:

– Innovation Leader: Despite fluctuations, Tesla remains at the forefront of electric vehicle innovation and sustainable energy solutions.

– Global Brand Recognition: Tesla’s brand and market presence hold significant influence in the EV sector.

– Potential Autonomous Leap: Rumors suggest Tesla might unveil a fully autonomous vehicle, potentially re-energizing investor interest.

Cons:

– CEO Focus Drift: Elon Musk’s involvement in numerous ventures raises concerns about his commitment to Tesla’s core operations.

– Regulatory Challenges: Navigating Chinese regulations poses significant hurdles.

– Valuation Pressures: The fluctuating stock may reflect overvaluation concerns, influenced by high expectations.

Competitive Arena: Tesla vs. BYD

BYD, a Chinese automaker, is making waves with its new driver assistance technology in vehicles priced under $10,000. Utilizing DeepSeek’s AI, BYD’s competitive pricing strategy challenges Tesla’s market stronghold, especially in China, a crucial EV market.

Innovations and Features

– Tesla’s Full Self-Driving (FSD): Tesla is progressing in the development of its FSD technology, which could redefine personal transportation.

– Sustainable Energy Solutions: Tesla’s commitment to sustainable energy and storage solutions positions it favorably in the growing environmental consciousness market.

Elon’s Ventures: Diversification or Distraction?

Elon Musk’s pursuit to reacquire OpenAI with a hefty $97.4 billion bid reflects his broader tech aspirations. While his innovative vision drives Tesla’s success, the diffusion of focus could impede operational effectiveness.

Pricing and Specification Challenges

Tesla needs to reassess its pricing strategies in light of emerging affordable competitors, especially to retain its market share in price-sensitive regions. Meeting regulatory requirements in geographies like China adds complexity to this challenge.

Sustainable and Security Aspects

Tesla’s commitment to sustainability is a pillar of its brand identity. However, balancing environmental commitments with economically viable solutions remains a challenge. Additionally, Tesla must address cybersecurity concerns for connected and autonomous vehicles.

Predictions and Investment Insights

Industry experts speculate a volatile short-term outlook but remain cautiously optimistic about Tesla’s long-term potential. If Tesla successfully innovates and adapts—particularly with its autonomous vehicle ventures—it could regain momentum.

Suggested Related Resources

For further insights and developments, consider visiting:

– Tesla

– BYD

– SEC – for regulatory information and filings.

Conclusion

In summary, Tesla’s current stock slump presents both potential opportunities and challenges. Stakeholders must navigate these turbulent times, weighing Musk’s scattered focus against the company’s potential for groundbreaking advancements. The market will continue to watch closely as this pivotal story unfolds.