- Tesla’s stock is significantly influenced by its advancements in AI, specifically in Autopilot systems, which may introduce new revenue streams through SaaS models.

- Machine learning improvements are expected to transform autonomous driving, impacting both the automotive industry and investor strategies.

- Tesla’s involvement in the energy sector, with a focus on battery technology and SolarCity expansion, aims to enhance sustainable energy solutions and financial stability.

- Geopolitical factors and Tesla’s strategic market expansions, particularly in China and Europe, play a crucial role in its stock’s future by opening up diverse market opportunities.

- Investors must grasp Tesla’s integration of technology and market expansion to capitalize on its stock’s potential in the coming years.

In the ever-evolving realm of stock markets, Tesla’s stock trajectory often serves as a focal point for investors and technology enthusiasts alike. As we navigate through 2023, the future of Tesla shares presents a fascinating intersection of innovation and economic potential.

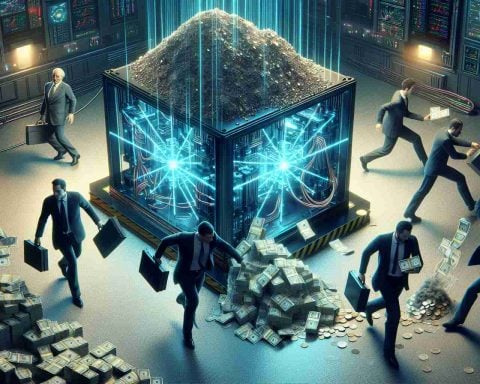

One groundbreaking aspect influencing Tesla’s stock price is its ventures into artificial intelligence. The recent advancements in Tesla’s AI-powered Autopilot systems have not only stirred debates on safety and ethics but also opened up new revenue streams through SaaS models. The continual improvements in machine learning algorithms are projected to revolutionize autonomous driving, potentially reshaping the automotive industry and investor strategies.

Another key factor is Tesla’s foray into the energy sector. With innovations in battery technology and the expansion of the SolarCity initiative, Tesla is redefining sustainable energy solutions. These developments could significantly bolster Tesla’s financial standing, providing resilience against traditional automotive market fluctuations.

Furthermore, geopolitical landscapes play a vital role in shaping Tesla’s stock future. With the firm’s strategic expansions into China and Europe, along with potential supply chain transformations, Tesla is poised to capture diverse markets. These regions are crucial not only for vehicle sales but also for establishing environmentally friendly infrastructure.

In essence, as Tesla continues to merge cutting-edge technology with strategic market expansions, its stock becomes an emblem of future-oriented investing. For investors, understanding this dynamic synergy is key to unlocking the potential of Tesla shares in the years to come.

Unlocking the Future of Investing: Tesla’s Pioneering Path in 2023 and Beyond

Overview of Key Factors Influencing Tesla’s Stock in 2023

In the constantly shifting landscape of stock markets, Tesla’s stock trajectory remains a focal point for investors and technology enthusiasts alike. As we make our way through 2023, Tesla’s innovative strategies and ventures present intriguing prospects for the future. Here are the key elements influencing Tesla’s stock price and what they mean for investors.

How Significant is Tesla’s Role in Artificial Intelligence?

Tesla’s AI Innovations: Tesla’s advancements in artificial intelligence, particularly with its Autopilot systems, are transforming the automotive industry. These AI-powered systems have become central to debates on safety and ethics but simultaneously open up new revenue streams through Software-as-a-Service (SaaS) models. The continual enhancements in machine learning algorithms are set to redefine autonomous driving, potentially reshaping automotive strategies and investor portfolios.

What Impact Does Tesla’s Energy Sector Expansion Have on Its Stock?

Energy and Sustainability: Tesla’s strategic expansion into the energy sector is reshaping how we view sustainable solutions. Innovations in battery technology and the expansion of the SolarCity initiative are propelling Tesla into new markets. These developments aren’t just about cars; they’re about sustainable energy solutions that enhance Tesla’s resilience against traditional automotive market fluctuations. As the world pivots toward sustainability, these innovations could significantly bolster Tesla’s financial standing.

How Do Geopolitical Factors Influence Tesla’s Market Strategies?

Geopolitical Expansions: Tesla’s forays into the Chinese and European markets are crucial not only for vehicle sales but for establishing green infrastructure as well. By positioning itself in these key regions, Tesla aims to capture diverse markets and adapt to potential supply chain transformations. Such geopolitical strategies are vital for supporting Tesla’s stock, ensuring its growth despite global uncertainties.

Related Insights and Resources

For those interested in exploring further insights into Tesla’s stock trajectory and the company’s ongoing innovations, the following resources can provide valuable information:

– Tesla

Final Thoughts

As Tesla continues to integrate cutting-edge technology with strategic global expansions, its stock epitomizes future-oriented investing. For investors, understanding this dynamic synergy is crucial to unlocking the potential of Tesla shares, not just in 2023 but in the years to come. The company’s blend of artificial intelligence, energy innovation, and geopolitical savvy highlights a promising trajectory that keen investors would do well to monitor closely.