- Nvidia’s stock initially dipped by 21% due to concerns over China’s DeepSeek but later rebounded as fears were reconsidered.

- The tech giant is preparing to release its fiscal 2025 Q4 results, with expectations to surpass Wall Street’s $38.13 billion revenue and $0.85 earnings per share predictions.

- Nvidia’s past performance suggests the potential for stock increases, with historic earnings announcements boosting prices in six of the last nine quarters.

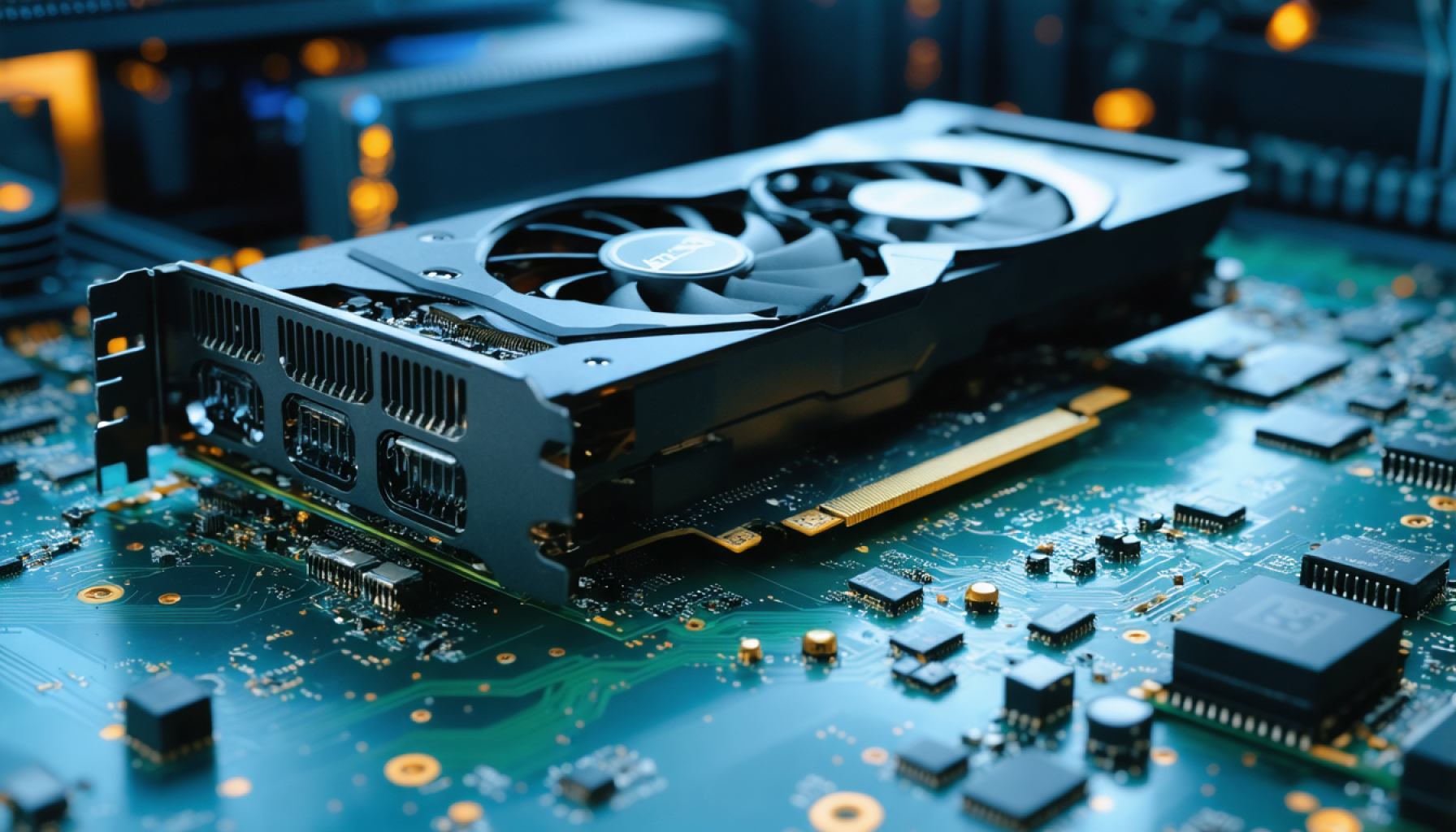

- Strong demand for Nvidia’s Blackwell GPUs signals optimistic prospects amidst escalating AI investments by tech giants like Amazon, Google, and Meta.

- Despite competitive pressures, Nvidia’s innovative capabilities and demand trends indicate promising long-term gains in the evolving AI market.

Amidst the vibrant hum of Silicon Valley, Nvidia finds itself edging toward a pivotal moment. Following the unease sparked by DeepSeek, the looming giant in China’s artificial intelligence sphere, Nvidia’s stock endured a dip. The creak of its share price sagged by 21% before rebounding as investors began to realize the fog of fear might have been overblown. Yet another wave of anticipation builds as Nvidia prepares to unveil its fiscal 2025 fourth-quarter results.

The stakes are thrillingly high. Nvidia possesses a reputation for thrashing Wall Street’s expectations, especially in the wake of AI marvels like OpenAI’s ChatGPT. Historically, Nvidia’s earnings announcements have resembled a catalyst, propelling stock prices upwards six out of the past nine quarters, a history that tantalizes investors with the prospect of a fresh leap upwards.

Could Nvidia find itself once again on the brink of surprising the markets? Wall Street analysts have set the bar for Nvidia’s Q4 at revenue of $38.13 billion and earnings per share of $0.85, a benchmark that would require formidable growth to surpass. The whispers within Nvidia’s corridors, however, hint at the ‘staggering’ demand for its Blackwell GPUs—a promising indicator.

Moreover, tech behemoths like Amazon, Google, and Meta are doubling down on AI investments, bolstering Nvidia’s prospects further. Even rival AMD’s recent revenue report seems lackluster in comparison.

The tech visionary eyeing Nvidia must grapple with a timeless investor dilemma: to seize the moment, or to ponder the longer arc of the market. Nvidia’s future may unveil a harder path, facing pressures like competitive valuations and emerging AI efficiencies. Yet, the company’s innovative prowess and potent demand suggest that leaning into Nvidia could yield bountiful rewards, not just in the immediate quarters, but in the grander scheme of AI’s golden evolution.

Nvidia’s Next Leap: Will AI Innovations Propel Stock Prices Skyward?

How-To Steps & Life Hacks

Investing in Nvidia: A Strategic Approach

1. Conduct In-Depth Research: Review Nvidia’s financial statements and current market trends. Focus on their revenues, AI initiatives, and competitive edge in the semiconductor industry.

2. Stay Updated on AI Developments: AI is central to Nvidia’s strategy. Keeping abreast of advancements in AI technologies, like the impact of ChatGPT and Blackwell GPUs, will guide investment decisions.

3. Analyze Competitors: Monitor rival companies such as AMD to understand Nvidia’s relative market position.

4. Consider Economic Indicators: Evaluate macroeconomic conditions that could influence Nvidia’s market, like global semiconductor demand and supply chain logistics.

5. Diversify Your Portfolio: Mitigate risk by diversifying investments across sectors, ensuring exposure beyond just AI or tech.

Real-World Use Cases

Nvidia’s Impact on Different Sectors

– Autonomous Vehicles: Nvidia’s GPUs are crucial in powering the AI systems in self-driving vehicles, enabling real-time data processing and decision-making.

– Healthcare: In medical imaging and diagnostics, Nvidia’s technology helps in analyzing large datasets swiftly, improving patient outcomes.

– Data Centers: With growing cloud-based operations, Nvidia’s GPUs are fundamental for enhancing computing power in data centers, which supports scalability and efficiency.

Market Forecasts & Industry Trends

According to a report by [Allied Market Research](https://www.alliedmarketresearch.com), the global GPU market size is projected to reach $200 billion by 2027, expanding at a CAGR of 33.6%. With Nvidia’s leadership in AI integration, its market share is expected to grow significantly.

Reviews & Comparisons

Nvidia vs. AMD: A Tech Battle

– Performance: Nvidia GPUs generally exhibit superior AI performance compared to AMD, with better support for machine learning frameworks.

– Price: AMD often provides budget-friendly alternatives, appealing to cost-conscious consumers, while Nvidia offers premium, high-performance options.

Controversies & Limitations

While Nvidia’s innovative strides are noteworthy, challenges such as geopolitical tensions impacting supply chains, or ethical concerns around AI’s societal impact, could potentially hinder progress.

Features, Specs & Pricing

The anticipated Blackwell GPUs are expected to set new performance benchmarks, strengthening Nvidia’s offerings in AI tasks. The pricing strategy seeks to balance cutting-edge features with affordability to outpace competitors.

Security & Sustainability

Nvidia is committed to reducing its carbon footprint by pursuing sustainable manufacturing practices and spearheading initiatives for energy-efficient GPUs, aligning with global ESG trends.

Insights & Predictions

As AI continues to revolutionize industries, Nvidia is well-poised for continued growth. Experts predict that strategic partnerships with major tech firms (like Amazon, Google, and Meta) to enhance AI capabilities will bolster its competitive edge.

Tutorials & Compatibility

Nvidia provides comprehensive resources for developers through the [NVIDIA Developer](https://developer.nvidia.com) portal, offering SDKs, libraries, and tools to maximize GPU utility.

Pros & Cons Overview

Pros:

– Market Dominance in AI

– Strong Relationships with Tech Giants

– Robust Financial Performance History

Cons:

– High Valuation Concerns

– Reliance on External Economic Factors

Actionable Recommendations

1. Monitor Financial Reports: Pay close attention to Nvidia’s upcoming earnings announcements for detailed insights.

2. Leverage Analyst Insights: Utilize expert analyses to stay informed about stock movements and market conditions.

3. Adjust Investment Strategy: Pivot strategies according to evolving market dynamics and Nvidia’s innovation pace.

By understanding Nvidia’s prospects and challenges, investors can make informed decisions, riding the AI wave towards potential market gains. For further insights, visit [NVIDIA’s] website.