- Nvidia’s stock recently fell by 6.9% despite exceeding revenue and profit expectations in its quarterly earnings report.

- Trade tensions and newly imposed tariffs have negatively impacted sales in China, a major market for Nvidia.

- The company remains optimistic, forecasting future growth above Wall Street estimates, though increasing inventory levels raise investor concerns.

- Nvidia’s stock has experienced significant volatility, with over 27 fluctuations greater than 5% in the past year.

- The decline might offer a buying opportunity, as historical investments in Nvidia have proven profitable over time.

- Ongoing evaluations of trade restrictions involving Nvidia’s technology in China deepen investor scrutiny.

- Volatility in Nvidia’s stock presents potential rewards, especially as the generative AI narrative continues to expand globally.

Amid the whirring hum of speculation, Nvidia’s stock took a 6.9% dive in a recent trading session, stirring up more than just Wall Street chatter. The decline came on the heels of a quarterly earnings report that, intriguingly, surpassed revenue and profit expectations, leaving investors scratching their heads.

The heart of the matter lies, in part, within the cobwebbed corridors of international trade tensions. Sales in China, a significant market for Nvidia, have slumped, rattled by the newly imposed trade tariffs. These obstacles threaten to trip up even the most dauntless companies, and Nvidia is no exception.

Yet, like an intrepid explorer unfazed by turbulent seas, Nvidia’s guidance for the upcoming quarter remains buoyant, exceeding the echoes of Wall Street’s estimates. Still, there is a storm cloud hovering over the increase in inventory levels, a detail that investors may find disconcerting.

Interestingly, Nvidia’s journey through the market over the past year paints a picture of volatility; the stock has see-sawed with more than 27 instances of fluctuations greater than 5%. This latest dip—not the first nor likely the last—speaks volumes about the gravity investors assign to the latest news, yet it doesn’t redefine their fundamental trust in the tech behemoth.

As whispers among investors concern deeper trade restrictions involving Nvidia’s cutting-edge technology to China, the market diaspora finds itself evaluating the landscape carefully. Could this transient dip morph into a golden buying opportunity? A look backward reveals that patience, in relation to Nvidia, often reaps rewards. An initial $1,000 investment five years past is now a surprisingly sumptuous sum.

While Nvidia’s path may currently appear rocky, there lies a core takeaway for the discerning investor: in volatility, there exists potential reward. The broader narrative of generative AI continues to unfold, promising transformative impacts across global business practices.

Is there more to Nvidia’s descent than meets the eye? Perhaps the tumultuous ride might just herald a favorable entry point into Nvidia’s intricate dance of tech and trade—a chance not to be overlooked in the tapestry of the AI revolution.

Unveiling the Strategic Moves Behind Nvidia’s Stock Fluctuation

Understanding Nvidia’s Stock Volatility

Nvidia’s recent 6.9% stock decline following a strong earnings report has puzzled investors. Let’s delve deeper into the factors influencing Nvidia’s market gyrations and potential strategic opportunities for stakeholders.

International Trade Tensions and Market Impact

1. Trade Tariffs with China:

– Impact on Revenue: China is a significant market for Nvidia, and new trade tariffs have led to a notable slump in sales. This has put pressure on Nvidia’s revenue from China, a critical region for the company due to its demand for tech and AI products.

– Strategic Responses: To mitigate the impact of tariffs, Nvidia is exploring opportunities in other emerging markets. Strengthening partnerships in regions less affected by trade tensions could diversify and stabilize its revenue streams.

Financial Insights and Predictions

1. Inventory Levels:

– Elevated inventory levels indicate Nvidia is anticipating future demand increases. However, this can be a double-edged sword as excess inventory might lead to markdowns if demand predictions fall short.

2. Quarterly Guidance:

– Despite the stock dip, Nvidia has provided upbeat guidance for the upcoming quarters. This optimism suggests confidence in their innovations and strategic position in AI markets.

3. Market Volatility and Trading Patterns:

– Nvidia’s stocks have fluctuated significantly, with over 27 instances of 5% swings in the past year. Historically, such volatility has presented buying opportunities, with long-term investments showing substantial returns.

Industry Trends and Predictions

1. AI Revolution:

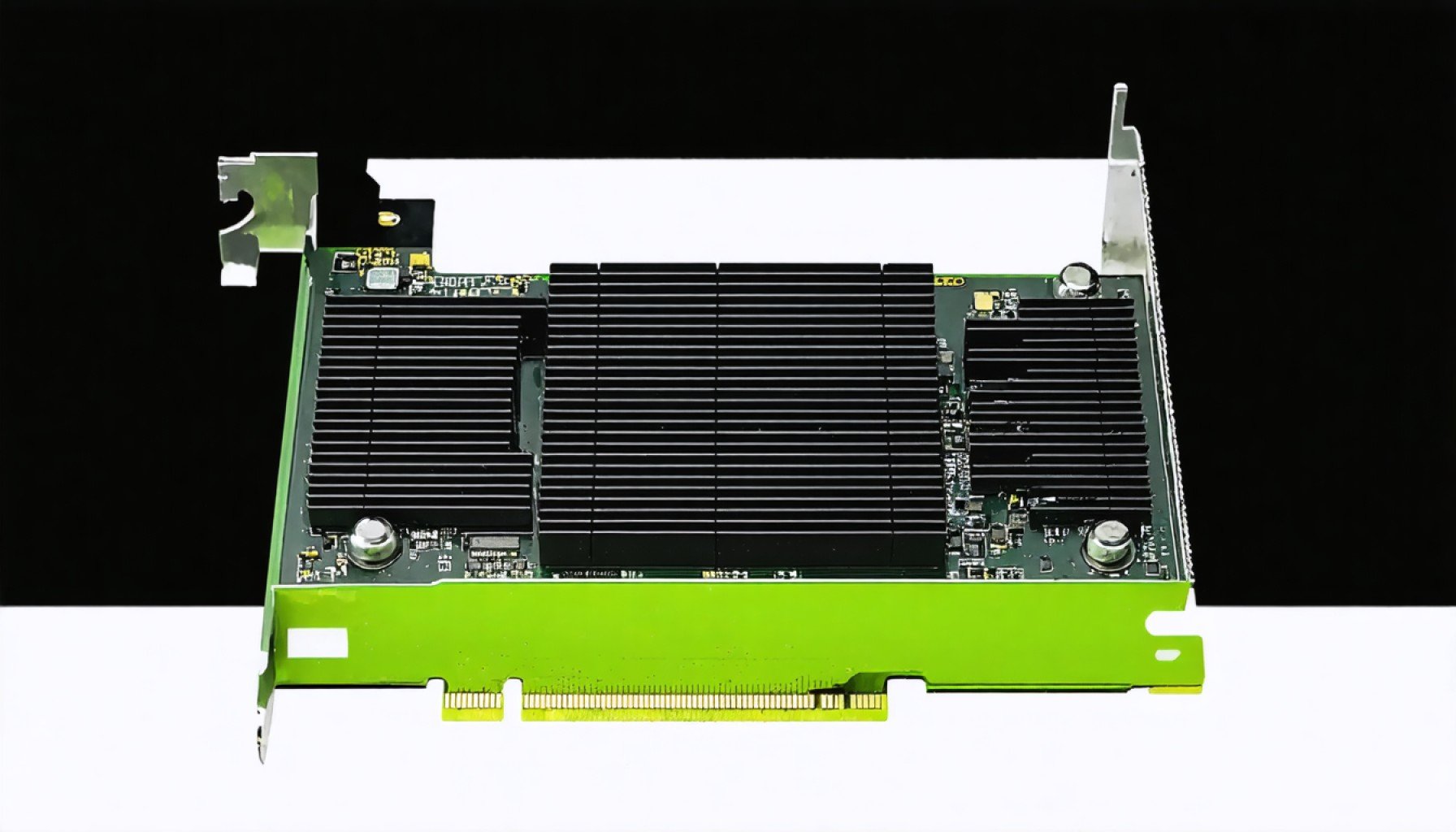

– Nvidia is at the forefront of the generative AI movement, with its GPUs being essential for AI model training. Continued advancements in AI technology could drive future growth.

2. Competitor Landscape:

– Nvidia competes with companies like AMD and Intel in the semiconductor space. Keeping an eye on competitor innovations and market share changes is crucial for investors.

Recommendations for Investors

1. Long-Term Investment Potential:

– Investors with a high risk tolerance might consider Nvidia’s stock slump a strategic entry point, given its historical recovery patterns and strong presence in the AI domain.

2. Diversification Strategies:

– A diversified portfolio can absorb potential losses from volatile stocks. Balancing investments in stable sectors alongside tech innovation is advisable.

Real-World Use Cases

1. Expanding AI Adoption:

– Nvidia’s GPUs are vital in various sectors, including autonomous vehicles, healthcare imaging, and cloud computing, indicating a wide array of future applications.

Additional Resources

– For further insights on Nvidia’s corporate strategies and global market approaches, visit the official Nvidia website.

Conclusion: Quick Tips

– Keep an eye on geopolitical developments: Trade agreements and tariffs can significantly impact international tech companies.

– Monitor industry news: Stay updated on AI innovations and Nvidia’s product launches for potential investment opportunities.

Nvidia’s current challenges underscore the importance of nimbleness in the tech industry, offering lessons in both the risks and rewards of market volatility.