- Consolidated Edison Inc. (CEG) is leveraging cutting-edge technologies to adapt its business model and influence stock price trajectory.

- CEG’s use of artificial intelligence and blockchain aims to increase efficiency and transparency in operations.

- AI is helping CEG optimize energy consumption, predict maintenance needs, and lower costs for enhanced financial performance.

- The company’s investment in renewable energy like solar and wind aligns with its commitment to reducing carbon emissions and attracting eco-conscious investors.

- CEG’s strategic shift towards green energy and technology may elevate its market standing and investor returns.

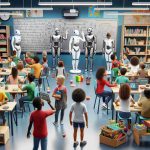

In a rapidly evolving market landscape, Consolidated Edison Inc. (CEG) is embracing cutting-edge technologies to redefine its business model, possibly influencing its stock price trajectory. As the energy industry witnesses unprecedented transformations with the advent of renewable technologies and smart grid innovations, CEG’s proactive approach could set it apart as a leader in reshaping energy dynamics.

Investors and stakeholders are closely watching CEG’s strategic adoption of artificial intelligence and blockchain solutions to enhance efficiency and transparency. These technologies not only promise to streamline operations but also safeguard data integrity, creating a robust, future-proof system. Through AI, CEG aims to optimize energy consumption patterns, predict maintenance issues, and ultimately reduce costs, which could lead to improved financial performance and potentially elevate stock valuations.

The shift toward green energy means that companies like CEG must innovate to remain competitive. By investing in solar, wind, and other renewable sources, CEG is not only reducing its carbon footprint but also appealing to environmentally-conscious investors. This strategic pivot is projected to bolster investor confidence, potentially reflected in positive changes to CEG’s stock price.

As the world moves towards sustainable and technological advancements in energy, CEG’s commitment to integrating these technologies positions it well for future growth. The interplay between innovation and sustainability might just be the catalyst CEG needs to elevate its market standing and offer promising returns for its investors.

CEG’s Radical Shift: Will Cutting-Edge Tech Boost Its Market Edge?

Pros and Cons of CEG’s Adoption of Technology and Green Energy

Pros:

1. Efficiency and Cost Reduction: The integration of AI solutions could drastically reduce operational costs by predicting maintenance issues and optimizing energy distribution.

2. Enhanced Data Security: Utilizing blockchain technology ensures data integrity and transparency, a significant asset in today’s digital economy.

3. Appealing to Green Investors: By investing in renewable energy like solar and wind, CEG increases its attractiveness to environmentally-conscious investors, potentially boosting stock prices.

Cons:

1. High Initial Costs: Transitioning to new technologies and infrastructure requires significant upfront investments and may strain financial resources in the short term.

2. Regulatory Challenges: Adapting to the rapidly changing regulations in energy technology could pose compliance challenges.

3. Integration Complexity: Merging legacy systems with new technologies can lead to operational disruptions and require extensive workforce retraining.

New Innovations and Trends in CEG’s Strategies

CEG is actively investing in innovations such as smart grid technologies that leverage IoT (Internet of Things) for better energy management. This involves using smart meters and sensors to provide real-time data analytics, potentially decreasing energy wastage and improving reliability.

Additionally, CEG is exploring battery storage solutions to address the intermittent nature of renewable energy, ensuring a continuous energy supply even when renewable sources fluctuate.

Market Forecast and Predictions

The future looks promising for CEG as it aligns itself with sustainable practices and cutting-edge innovations. Market analysts predict a steady growth trajectory for CEG stocks, largely driven by its strategic focus on renewable energy and technology integration. As global demand for sustainable energy solutions rises, companies like CEG may see an uptick in their market value and share price.

Key Questions and Answers

1. How will AI and blockchain impact CEG’s operational efficiency?

– AI’s predictive capabilities can minimize maintenance downtime, while blockchain ensures secure and transparent data transactions, leading to improved operational efficiency.

2. What are the potential risks associated with CEG’s strategic shift to renewables?

– Potential risks include high initial installation costs, the intermittency of renewable sources, and challenges in integrating these new systems with existing infrastructure.

3. How could CEG’s innovations in energy tech affect investor sentiment?

– By pioneering in AI and blockchain for energy solutions, CEG demonstrates forward-thinking strategies that may increase investor confidence and interest, potentially boosting stock prices.

For more updates and information, consider visiting Consolidated Edison.