A New Era of Tech Investment Prospect?

The buzz surrounding quantum computing has taken Wall Street by storm following Alphabet’s recent announcement about its quantum chip, Willow. This breakthrough claims to solve complex problems in five minutes—something even the fastest supercomputers would need eons to accomplish. As a result, stocks associated with quantum technologies, including D-Wave Quantum, Quantum Computing, Rigetti Computing, and IonQ, experienced significant spikes.

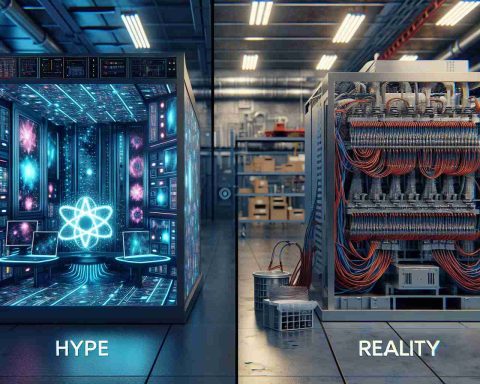

However, the excitement might be premature. Industry giants like Nvidia’s Jensen Huang and Meta’s Mark Zuckerberg have cast doubt on the technology, suggesting that practical applications of quantum computing may still be decades away. Their skepticism has led to volatility in quantum stock prices, with many seeing declines shortly after the initial surge.

While quantum stocks are gaining attention, the reality is that most lack substantial revenue. For instance, IonQ’s revenue projections for 2024 are modest compared to its soaring market cap.

Investors are advised to consider more established technologies for investment. Artificial Intelligence (AI) is already making waves across diverse sectors, with companies like Micron Technology experiencing explosive growth thanks to robust AI demand. Micron recently reported a staggering revenue increase of 84%, and TSMC, the world’s largest chip manufacturer, is benefitting from similar trends.

In the tech landscape, AI appears to be the safer, more rewarding bet right now. With its tangible advancements and market momentum, it seems poised to offer returns that quantum computing stocks may struggle to match in the near future.

The Broader Implications of Quantum Investment Trends

The surge in interest surrounding quantum computing not only impacts individual stock prices but also raises profound questions about technology’s evolving role in society and the global economy. As nations vie for tech supremacy, quantum computing could redefine competitive dynamics on the international stage.

Countries investing heavily in quantum technologies view it as a strategic asset that could enable breakthroughs in various fields—from cryptography to drug discovery. This competition fosters a culture of innovation, but it also raises concerns about inequity in technology access. Nations lagging in this race may find themselves at a disadvantage in critical areas, straining international relations and igniting fears of a new form of digital divide.

On an environmental front, the energy consumption of quantum computing facilities could pose sustainability challenges. As these technologies develop, they may require vast resources, exacerbating our current energy crisis, particularly if reliance on traditional energy sources continues. How the industry addresses these challenges will be pivotal.

Looking ahead, future trends may include greater collaboration across sectors. Businesses could leverage quantum computing to enhance AI algorithms or improve supply chain efficiencies, creating a synergistic relationship that transforms existing industries.

In summary, while the current hype may not indicate immediate profitability, the implications of advancing quantum technology warrant serious contemplation regarding its impact on global economies, societal structures, and environmental sustainability. The road ahead may be long, but its significance can’t be overstated.

Is Investing in Quantum Computing the Future or a Fading Trend?

Understanding the Quantum Computing Landscape

The recent advancements in quantum computing have captured immense attention in the investment world, particularly following Alphabet’s announcement of their innovative quantum chip, Willow. This chip purportedly offers solutions to extremely complex problems in mere minutes—far surpassing the capabilities of traditional supercomputers. Consequently, stocks tied to quantum technologies such as D-Wave Quantum, Rigetti Computing, and IonQ soared in value, signaling a potential gold rush in this nascent field.

The Quantum Computing Hype: Hurdles and Skepticism

Despite the initial excitement, industry leaders like Nvidia’s Jensen Huang and Meta’s Mark Zuckerberg caution against premature optimism. They assert that the practical, real-world applications of quantum computing remain many years in the future, which may indicate that current valuations of quantum-focused stocks are inflated. As a result, we have witnessed considerable volatility in these stocks; the initial spikes were often followed by sharp declines, revealing a speculative bubble that could burst as quickly as it inflates.

Market Dynamics: Revenue vs. Valuation

A critical look at the revenue generated by quantum computing companies reveals a stark contrast to their market caps. For example, IonQ’s projected revenue for 2024 is relatively modest given its astronomical market value, raising questions about the sustainability and viability of such investments. Investors may find it prudent to diversify into more established tech sectors that demonstrate consistent revenue streams and growth.

The AI Advantage: A Safer Bet

Currently, Artificial Intelligence (AI) leads the charge in technological advancements, offering tangible benefits and robust market demand. Companies like Micron Technology have reported extraordinary revenue growth—Micron experiencing a remarkable 84% increase—as they capitalize on the rising demand for AI-related products. Furthermore, TSMC, a dominant player in semiconductor manufacturing, is seeing similar positive trends attributed to increased AI utilization across various industries.

Pros and Cons of Investing in Quantum Computing

# Pros:

– Potential for Revolution: If successful, quantum computing could revolutionize fields like cryptography, materials science, and pharmaceuticals.

– Early Investment Advantage: Investing early in quantum computing could yield significant returns if the technology matures faster than expected.

# Cons:

– Uncertain Applications: Many quantum technologies are still theoretical, with practical applications remaining uncertain.

– Volatile Stock Prices: Significant fluctuations in stock prices could lead to substantial losses for investors.

Future Insights: Where is Quantum Computing Headed?

While quantum computing offers the possibility of groundbreaking innovations, many analysts suggest that the technology’s widespread implementation is still years—possibly decades—away. As we consider current investments, AI not only stands out as a more stable alternative but also continues to expand into new applications, indicating a stronger market trend.

Conclusion: Navigating the Tech Investment Landscape

In conclusion, while quantum computing is enticing, the hesitation from industry leaders, coupled with the volatility of related stocks, underscores the need for caution among investors. As AI technologies demonstrate tangible results and profitability, they present a safer and potentially more rewarding investment opportunity in today’s tech landscape. For detailed insights on investment strategies, visit Investopedia for more information.

Investors should carefully evaluate their portfolios with these trends in mind, ensuring a balanced approach that leverages both emerging technologies and established market players.